skip to main |

skip to sidebar

Sorry friends I have to close the blog for now due to personal circumstances. Maybe one day in the future it will pop up again. It has been fun reading the tea-leaves of RE, and then some, for the last few years.

Wish you all health and success whichever side of the fence you are on.

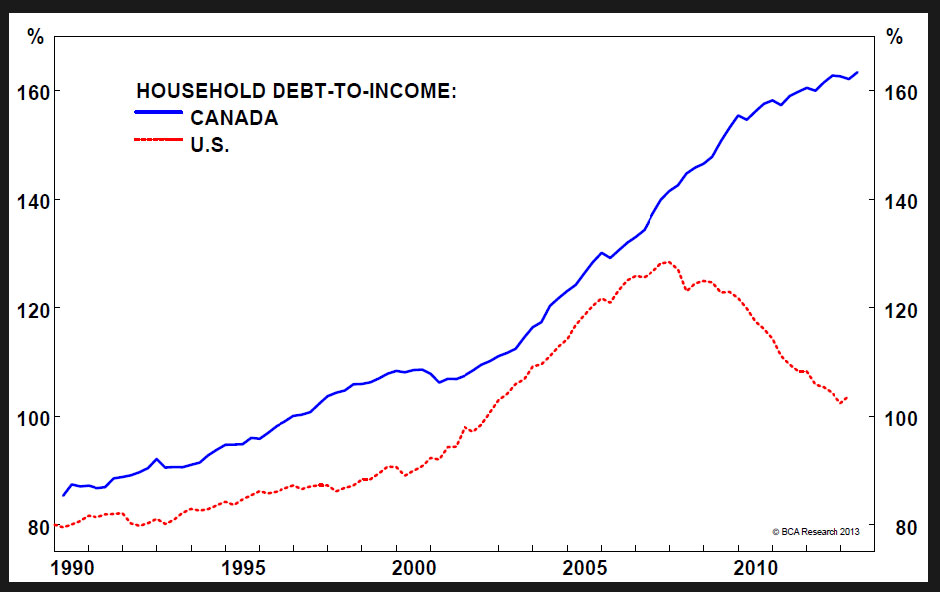

Not able to put up a proper post, just more food for thought. THIS is why so many of us are bearish (and yet we have been confounded by the tardiness of the correction)...

Source : BCA Research

The Averages powered up in September per Larry's numbers.

Not altogether unexpected. While not as strong as August, September this year was a lot stronger than 2012. Was this the last of the pre-approvals going through? Certainly there seemed to be a division later in the month with lower sales/list showing up.

We have also had some big sales. As I documented earlier in the month, there were two $7 Million + sales in West Van alone (and a slew of $4-5 M sales). One was to a local buyer and one to a HAM from what I can ascertain. These numbers certainly baffle me. To spend $7 M on a house, requires a net worth at least twice that, and at a tax rate of even 30%, that's over $20 Million of earnings!

How many people have that sort of income?

Then I remembered that some banks were paying their senior executives over $10 M every year as was Telus.

MOI ends the month at over 7 for SFH and 6 for Apartments.

The bubble is not restricted to residential BTW. I spoke with a commercial realtor a few days ago and he said there is so much money in this town looking for a home, that yields on smaller, good retail and office packages have reached silly low levels.

The money is local professionals looking for diversification, Eastern retired money and of course hot offshore money. "If there is a tenant turn-over, the lost rent and expenses associated with tenant inducements and costs can bring the yield down to zero for that year. They just want a low yield in a tangible asset that can keep up with inflation. Of course if there is a serious recession in our city, there will be a LOT of unhappy landlords".

He explained that is one reason for the high turn-over of tenants in particularly retail businesses. "The rents are just too high". For example it is cheaper for a landlord to leave a unit empty until it finally rents, even to a weaker tenant , and lose the few % return while he/she waits RATHER than lower the rent much. If you lower the rent say 10%, that could drop the value of your property significantly in this bloated market, where every dollar of return is accounted for in the price.

Whence go we? The pre-approvals must be done. The market now sinks or swims on it's own. I suspect the HPI will still come in lower for September (it will if compiled fairly by the REBGV IMHO).

We should know soon if this is the case. As for the blog, I will be going fallow for a couple of weeks. I have a few matters to attend to and hope to be done near mid-month. If all goes well, I will return with commentary and the numbers at that time. May throw stuff in the comments from time to time.

Have a great October.

This conversation was over heard on the GG Gondola by a friend. Not by me, but by a friend who is reliable and does not exaggerate.

Lady. "I am 53 and thought I was going to retire when I was 60, but I just took out a second mortgage to help my son buy an apartment. That just buries me in debt again".

Friend: " I am even older and thought I would be free of debt by now, but my mortgage hasn't been paid out, and I haven't been able to clear my credit card debt before another holiday comes along".

Male friend: " I recently went into my bank to get an higher limit on my credit card for a month, and the bank employee kept trying to sell me on getting a $25,000 line of credit. "Just sign here and $25,000 will be deposited into your account". I had to fight her off.

They then discussed how the banks almost forced debt on people. "Quite the difference from a few years ago, when you had to prove you could replay them. Now they don't care if you are nearly broke with debt. "Just get more debt to pay off the old debt."

Then another occupant of the gondola spoke up and said he worked for CIBC and that they had quotas of credit cards and personal debt to meet, and if they don't there was pressure from Managers to get there, that's why they kept pushing customers to get into more debt.

That is were we have got to. The banks have become drug pushers. Except the drug is debt. We are supposed to hope the addict will quit using themselves. And if you can't get your drug from the banks, there are dozens of fringe outfits willing to give you money..'If you have equity in your home'. Which just drains whatever equity you have managed to build up in your home.

This can only end badly.

The US Fed blinked. Actually it did't blink, it closed it's eyes and assumed the fetal position.

After talking tough about backing off on buying the US Government debt (the definition of ponzi btw), it stood pat and said.."we will..we will...keep buying! forget what we said earlier this year".

Actually it worked out ok for me, as my poor preferred shares which had been beaten into mush caught a bid.

However it did bring interest rates down a notch now that everyone sees the Fed for the blow-hard-but-do-nothing that it is.

The Canadian bond market which is tied by it's apron strings to the US one also got a bounce and rates dropped.

Now how about September? What are we looking at. Well so far it looks to em like we are going to get some weakness in the HPI and averages for the month.

I see mid range homes (would be super upper end anywhere else) $1.2-$1.6 M selling for a 4-8 % below asking. Of course the asking prices are pretty crazy, made up numbers , but that didn't deter the delusional buyers before.

I have said before that if September didn't show some weakness that I would probably suspend or close this blog but it looks like you may have to put up with me a bit longer.

Assuming you are waiting to buy or have decided not to, then you have a nice pile of cash building up. What are you doing with it in this forced low rate era?

None of the Central banks (UK, Canada, Euro), despite talking tough about soaring consumer debt have had the balls to increase rates. We are STILL sitting with rates at emergency levels and below inflation.

So what options do we have for our money?

Well a few and none are that enticing.

There is the GIC. Rates are pretty low at the moment. The banks still haven't budged much from the 1.0-1.4% for a one year fixed. You can get a little more by bargaining with your advisor. This has always irked me BTW. Why not just post better rates for everyone. Our banks, like our telecom carriers either need competition or serious regulating.

I just picked up 1.8% for a one year at ING direct which is owned by Scotia now. I got this from a brokerage account and was better than their posted rate. Other institutions with lower credit ratings offer up to 2%for a one year and 3% for a five year fixed. The CDIC will insure up to $100,000 if the GIC is under 5 years.

Either way you slice it, it isn't a big chunk of money. After taxes, it is below inflation. It used to be that a one year GIC matched inflation after tax and a two year beat it. Not now that the Central banks are trying to force us to speculate (and then complain when we do)

So what else is there?

Bonds.

You can buy bonds via any brokerage account. The rates are not much better than GIC rates at present for high credit companies and Government of Canada bonds are even lower. You can tweek things by buying stripped bonds which have a lower tax rate (capital gains instead of interest taxation). You can google this if interested.

Preferred shares.

These are shares that behave like bonds. They come in several flavours, some pay a steady % until maturity, others reset the rate depending on the Bank of Canada rate or rates for a ten year bond, others maybe convertible into the shares of the issuer. They pay higher rates as they are considered 'long bonds'. However as they are shares too, they are taxed better than bonds and so a 5% yield in preferreds would be the same as getting almost 7% in a bond if you pay tax at the highest rate.

Here is a good site which explains and tracks them. Though he also writes of other stuff in his commentary which I usually skip over.

Garth Turner used to be a big proponent of them on his site Greater Fool. They have done very well for the last few years and then got slaughtered recently as rates have been rising. He has not mentioned them recently :)

Then there is the stock market. You can buy stocks directly, or mutual funds or index funds etc. Bank shares have done very well as they have been in the sweat spot.

They have borrowed short (from all the people having one year GICs or getting near zero interest in their savings account) and lending out several % higher to mortgage borrowers. Even though rates are low, the spread between the short end and then long end of the rates curve has been widening and therefore the banks have been making even more money than before.

The best thing is that they have been doing this risk-free. Anyone with high leverage or poor credit risk they passed off to that garbage can of risk - the tax-payer back CHMC. A scandal IMVHO.

However this circus is slowly coming to an end, as outsiders from the World Bank to Investment houses to independent economists have told our Government how poorly risk is managed at the CMHC, they seem to be finally getting the message.

The stock market was a good place to be for the last four years, especially the US market. But I am too leery to put new money unless there is a good correction. Rising rates are usually bad for the earnings of companies

That's about it. Can't think of many more options.

What are you doing out there?

Larry as usual provides the numbers.

Detached MOI = 6.9

Attached = 5.6

Condo = 6.1

These MOI are in the 'balanced' range. However they are a LOT lower than last August. Is this demand pulled in because of the interest rate and CMHC changes or is the Bull back?

Some higher sales have skewed the numbers. Lots of local and HAM big buys in August in the Multimillion range have pulled the numbers up.

Is HAM buying drying up? Not yet. There are some signs that emerging markets are under some financial stress with the Fed TALK (only talk so far) of pulling back on ponzi monetary policy.

However the Chinese PMI number has come in above expectations and that may bring more hot money to our shores.

As I have said recently, we SHOULD have seen the top with everything stacked against RE. However there could be some new dynamic that I have not taken into account which will ignite further buying and if so, then it is time to move on. We will know very soon if this is the case.