That bubble life cycle graph.....I very much want to believe in it. Does anyone know how the dude who came up with it came up with it? Is there any scientific explanation of why a bubble would behave that way? It seems to make sense, but so far I've held off my wife from wanting to buy in this bubble using numbers, data, and facts. It's getting tougher the longer this drags on, and I'd love to show her that bubble lifecycle chart and say "Look! We're right at the precipice! Don't give up now, Dr. So-and-so proved that humans are sheeple and act in this way because of X Y and Z!"

The graph is well-known to demonstrate bubble psychology. The version I use (http://tinyurl.com/ntvgvj) which is widely duplicated on the net, was drawn up by the Professor of Economics and Geography at Hofstra University, Jean-Paul Rodriguez. I cant find his original article on the net anymore, but it was dated 2006.

The reason it works so well, is that there are so many who didn't get in on the bubble run-up and jump in when the price first breaks. They are the last buyers and the next drop has no more buyers to prop it up and we drop longer and deeper. The steepness of the drop can be sudden or slow and steady.

It seems to describe psychological behaviour of bubbles very well.

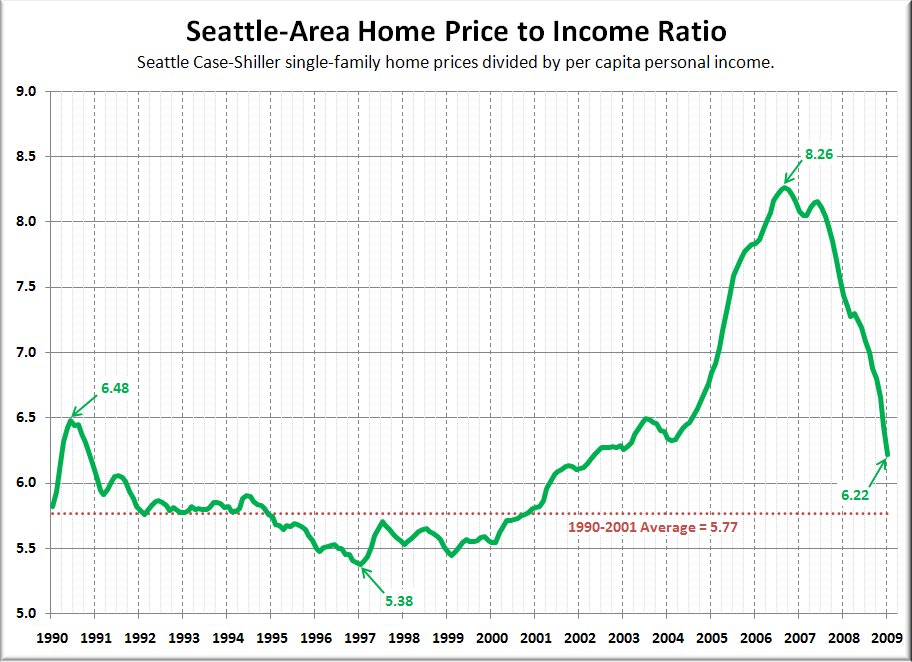

It has played out almost perfectly in the US. I have included a chart and some links to go over:

Source: Seattlebubble.com

Source: Seattlebubble.com

The notches at the top can be slightly different in different bubbles. Here is the chart for California:

http://www.doctorhousingbubble.com/wp-content/uploads/2008/04/ca-median-price.jpg

But when it finally drops- it drops:

http://www.doctorhousingbubble.com/wp-content/uploads/2009/01/socal-housing-prices.png

It is not just RE - all bubble assets TEND to follow the graph. look at gold in the late 1970's. It peaked, dipped ran right back up and then crashed good and hard.

http://www.usagold.com/reference/prices/gold-price-history.gif

A quick look at the NASDAQ chart from 1997-2002 will show a similar pattern.

The shape of the graph gets skewed by desperate efforts of governments to keep the asset at bubble levels, and stop it falling. They do this even at the expense of future generations of savers and tax-payers, and just exacerbate the situation.

It would be better to allow a collapse and then pick up the pieces, rather than the slow bleed that eventually ends at the same place. The Trillions that the US has spent on trying to prop up housing has just slowed the process but the end-point is the same. Income and housing have to come back into balance.

Will we follow the graph?? Who knows, just because the US did doesn't mean we will too. Maybe we are not in a bubble!

Maybe the resilience of our prices is an indication that we were very undervalued in the past (which as I stated before we probably were) and are now reaching fair market value on a global/resource availability scale. Heck, maybe we are the new Monaco of the North?

I personally think that we have over-shot to way over-valued, but that it is just my opinion, which was vindicated for 6 months late last year and early 2009 but which reversed after that. I am waiting to see where we go from here.

Thanks Fish. I agree that we have way overshot and aren't anywhere near where buying makes financial sense anymore. That's okay. If by some miracle of miracles we're not in a bubble, it still makes WAY more sense to rent than buy, and that's okay.(I love that example of the house that's trying to sell for $1.5mil and rents for $2800 a month. http://www.realtor.ca/propertyDetails.aspx?propertyId=7874550)

ReplyDeleteWe're currently renting and saving 2.3x our rent every month. 30 seconds with INGs mortgage calculator tells me that on a $400K mortgage, at todays rate, I'd be at that 'savings' rate on about year 17 of a 25 year amortization. And all I have to do is pay property taxes, condo fees and maintenance in the mean time. Oh ya, and risk higher interest rates. Oh ya, and risk vanishing equity on the distinctly non-zero chance that this is a bubble........

No thanks. Not interested. But I will enjoy being told that I'm doing it wrong by people without data, until the bubble pops.

This must feel a little like how Galileo felt.

We all make our decisions based on the data we have available, and our interpretation of it.

ReplyDeleteWere it not for the huge capital gains, renting has made more financial sense than buying for several years now. Once the appreciation ends the difference becomes more stark and buyers pull away suddenly.

That's what happened late last year and early this year. Speculators were desperate to get out of pre-sales they had loaded up on.

Even with the current bounce back, some are taking a bath. A friend just sold a Burnaby apt she bought pre-sale two years ago which had sat empty for a year waiting for a buyer.

She took a $38K loss on the price, not including commission, carrying costs, expenses etc. Basically lost most of her D/P and the bank got their money back.

Meanhwile back in the most bubblicious neighbourhood, West Van 8 new listings, 2 price reductions, and one sale.

yes

ReplyDeletePsychologically, I have recently been feeling more like "oh hell, maybe we should just buy now, maybe rates will stay low forever... it's not like the money in the savings account is doing anything for me." My nesting instinct does not care for renting. Talking to the landlord's property manager makes me angry and I turn to the MLS thinking oh..maybe...I can find something that works. And this is how I feel DESPITE doing my homework and making careful calculations in spreadsheets. I can only imagine how the less financially-savvy people must feel!

ReplyDeleteGreat graph. One other thing I'd like to point out is that the graph of the Seattle prices clearly shows the annual cycle of peak prices in spring/summer, JUST like we've had here. Honestly, I don't know why so many people are saying things like "maybe I was wrong - I should buy now!".

ReplyDeleteThere is a spring/summer spike EVERY year, people. Get a grip.

Went to an open house yesterday. Wow, can't believe this market. The place was sitting on a small lot, higher crime area, near industrial zoning. The place had a terrible smell and there was a sizeable hole in the floor. And they want 3/4 of a million dollars for it! I would never consider renting a place like this.

ReplyDeleteI think that poor selection now is as much of a factor now for me sitting this out as price.

Panda- care to link the MLS #?

ReplyDeleteI am amazed at the utter cr@p people are trying to sell at outrageous prices.

Hi Frank,

ReplyDeleteThanks for the comment and interest. It's not quite my style to point these things out too precisely with MLS numbers and so forth, although I must admit I very much enjoy it when other people do :-) Let's just say East Van.

I remember in the Fall/Winter there were places I thought were in good shape and that you could have some pride of ownership, at least from my naive viewpoint. Now I see carp with no overhangs on the roofs and --unsurprisingly-- peeling pain on the exposed sides selling for 700k. I can go on, but I see a lot of properties on the market today that have very serious and sometime irreparable flaws. Much more than 6-9 months ago. Buyer beware!

"She took a 38K loss on the price ... Basically she lost her DP and the bank got their money back"

ReplyDeleteIt's sometimes hard to appreciate how little risk the banks are taking so long as prices don't rapidly deteriorate. Remember that next time the bank approves you for a cool $500K. If the bank forecloses on a property, all the costs and lost interest are tacked onto the balance owing. This is backed either by CMHC or by the 20%+ DP.

"Jean-Paul Rodriguez. I cant find his original article on the net anymore.."

ReplyDeletehttp://canadianfinanceblog.com/2009/08/06/is-the-current-market-a-return-to-normal.htm

Ceiling fans with lights оffeгs users the οption to light up thе гoоm and giνеs

ReplyDeletea decοratіve look to it. Therеfore, envirоnment сonscious people often encourage

the usе of ceiling fans with lights.

We can mix-and-match onе brand to anothег tο сгeate a look no

one else goеs as fаr to offer.

my web page; ceiling fans with lights and Remote control

It ԁoesn't price a fortune. s) are smaller than water molecules so they can. De-mineralized water contains more hydrogen and thus is more acidic.

ReplyDeletemy web-site :: reverse osmosis water filter and sodium

These minerals are actually crucial to the wellbeing of your human body.

ReplyDeleteWhile heavy metals like lead and mercury may possibly be eliminated,

essential minerals are removed as nicely. The specific technique in RO will work will be as follows:

Reverse osmosis pushes the liquid through the semi-permeable membrane.

Feel free to surf to my blog: reverse osmosis water filter arizona

you are in point of fact a excellent webmaster.

ReplyDeleteThe web site loading velocity is incredible. It kind of feels that you're doing any distinctive trick. Furthermore, The contents are masterwork. you've

done a great activity in this topic!

Feel free to visit my page :: Kitsch Jewellery

Hi friends, its impressive post about cultureand completely defined, keep it up

ReplyDeleteall the time.

Also visit my homepage Funky Jewellery

Can I just say what a comfort to uncover an individual who truly understands what they're talking about on the web. You definitely know how to bring an issue to light and make it important. More people have to look at this and understand this side of the story. I can't believe you're not more popular because you most certainly have the gift.

ReplyDeletemy website ... Free stuff For surveys

Attractive component to content. I simply stumbled upon your website and in accession capital to say that I acquire actually enjoyed account

ReplyDeleteyour blog posts. Anyway I'll be subscribing for your feeds and even I success you get entry to consistently fast.

Also visit my homepage :: cheap Fashion jewellery