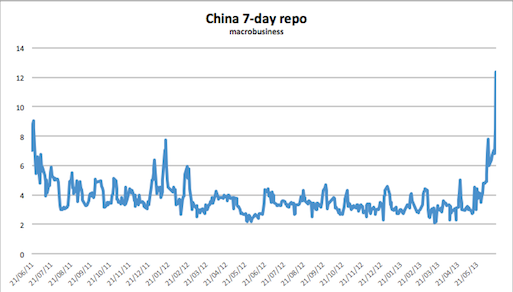

China growth has slowed and may dip under 7%. Liquidity is tightening and over-night interbank lending rates have soared.

Canadian Interest rates have soared

The CMHC has been reined in from the catastrophic organization it was. The board of directors will hopefully be replaced soon and this Government lunacy will end.

8500 more people left BC in 2012 than came in, many no doubt driven out by high housing costs and and growth forecasts are dropping.

Commodities are in a slump. Wood and paper make up 30% of all our exports, at 10 Billion dollars.

Gold has been crashing and many junior miners are near shuttering their offices and laying off their staff. The rest of mining sector is faring better but will need a rebound in copper, coal, oil and Ngas soon. Even agricultural commodities needed to feed the world's burgeoning population has dropped, which shows us how much 'fast money' there was in these from low interest rates.

BTW we spent $16 Billion on healthcare. Ie 1.5 times our largest export. Unsustainable and likely to get worse. A commodity slump will make the Province's debt problem much worse, which means pretty soon the Province will be forced to make cuts or lose it's credit worthiness.

Higher rates, lack of affordability, tepid jobs market, China under pressure, commodities in a major downturn, Provincial Government with fiscal restraints, major build-outs ended, lower growth forecasts, an aging population which is consuming a lot of dollars but not paying very much in, the CMHC being held back from it's own stupidity, the Federal Government in a different mood from 2008 and more people leaving than coming in....and yet there are people still buying!!

Some people are even paying over assessed they are so desperate to buy.

If this perfect storm does NOT lead to a major drop, then I need to rethink my economic ideas.

The Chinese Government blinked

ReplyDeletehttp://www.bloomberg.com/news/2013-06-20/china-money-rate-jumps-to-record-as-pboc-holds-off-on-cash-boost.html

The alternative is to face major revolt

The rate crash down is a pure example of economic slow down and it can be gain by promoting more gold by making people to buy gold bullion bars. Online promotions will be an added advantage for them.

ReplyDeleteI believe your post is really awesum and helpful for real estate

ReplyDeletehas become the major concern

Thanks for the tips. Windsor Real Estate

361 new

ReplyDelete203 price change

184 sold

7901 detached

9423 attached

Interest rates rising. Stock-market crashing. China is in a liquidity squeeze and folks are still buying. Buy. Buy. Buy before all the Re runs out...quick.

ReplyDelete381 new

291 price change

222 sold

7868 detached

9420 attached.

Unbelievably, or not, many people have no idea that any of these events are occurring. Or, if they do know, truly believe that none of this noise can effect Vancouver.

DeleteIn all seriousness, even as a bear I'm getting a little worried, there seems to be a lot of things going against Vancouver real estate, and the fact that it has no earnings protection could mean that the bid just drops off a table at anytime. If that is the case, even us bears could be hurt by the collateral damage inflicted on the overall economy. Stay liquid friends.

No doubt a RE slow-down will hurt everyone. Bears and Bulls alike. Economic weakness is just part of it. retrenching banks and the CMHC monster's debt load is the other part.

DeleteI used to think we would have a correction but not any more we are in crash mode and yes it never looks like a crash until one day you wake up and there it is in your face(yes I have seen both of vancouver busts the second time it was weird because I was gone on holidays for 5 months and came back to see a total bust just in that time frame

ReplyDeleteI have given up making any predictions about Vancouver RE. All I do know is that it is wildly over-priced for the local population's income. A slight increase in rates and that gap will become very apparent. Off shore buyers are a different entity and they are not affected by interest rates.

DeleteDO NOT GIVE UP.. I have been waiting since 2005 I gave up and bought a house and then started thinking what the f... am I doing 1 mill for an old house so we sold and are now renting and very happy. I met a realtor from my childhood that did alot of transactions with my family kinda like a aunt but we would never say that to her because being young is part pf realtors thang she dealt with alot of taiwan in the last bust and now the mainlanders but she has told me they are not buying no longer. It is just locals trying to get in on low rates and some specs that believe re never goes down. (to sum it up she is asian and a killer re agent) SO NEVER GIVE UP AT THE LAST STAGE OF THE GAME

ReplyDeleteInterest rates clearly don't matter

ReplyDelete370 new

209 price change

271 sold

7890 detached

9444 attached.

One of the more bizarre descriptions of a house. What are they selling the house or the owner?

ReplyDeleteA truly delightful mix of old fashioned charm, good bones, and spotlessly clean.......and yes, I am still talking about the house! Although the owner matches the description to a T. A lovely three level split, with good size bedrooms, a main floor family room just off the kitchen, formal dining and an open spacious living room. This is a perfect family home, a great back yard for the kids to play & a stone's throw to all the good schools.

MLS # V1004404